You don’t need a fortune to start an ecommerce business. Without a physical store, maintenance expenses and (usually) labor expenses are significantly reduced for online sellers. With these low startup costs, many merchants flock to sell online with the hope of making an easy profit.

Selling online, however, isn’t automatically profitable. Merchants have to stay ahead of fierce ecommerce competition and account for unique online selling expenses, such as marketplace fees and shipping costs, in order to stay profitable.

Online merchants can gain control over their profits by tracking two factors: the demand and margins of their items. Gauging buyers’ interest in products and staying aware of costs and revenue empowers merchants to predict earnings with accuracy and drive more profit.

To help sellers determine demand and profit margins, we’ll break down these two elements in this article. We’ll explain the best ways to assess demand and margins for measuring profitability, with examples from major marketplaces.

With this systematic approach, sellers can plan for profitability by selecting high-demand items and managing costs to ensure margins.

Gauging demand

The first step in measuring profitability is knowing what buyers want. Your product has to have sufficient demand in order for you to sell enough items to make a profit. To gauge online buyers’ interest in your items, you have to identify:

-

- How often consumers are searching for your products

- How many merchants are offering your product

- How often your product is being sold

These questions paint a picture of your business’ profitability. With this consumer and competitor information, you can predict how much you’ll sell, optimal pricing levels, and other critical factors that impact your earnings.

How often consumers are searching for your products

You know demand for your product is high when there are frequent searches for your items.

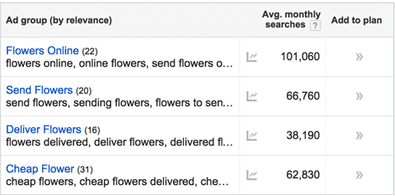

You can easily see how many people are searching for items that are similar to yours by using Google Keyword Planner. This tool indicates monthly search volumes for relevant product keywords. Any merchant with Google AdWords can use the Keyword Planner tool, regardless of which marketplaces they use.

[Source]

Seeing these frequently-searched keywords and phrases allows you to align your business with buyer demand. You include the words more on your store, move up in search, and gain better visibility to encourage more site visits and sales. For example, a seller who sells flowers online might see the keyword search data above and edit their homepage to have more information about deliveries. With search volume insights, you’re able to shift your online retail business towards the aspects of your industry that buyers are most interested in.

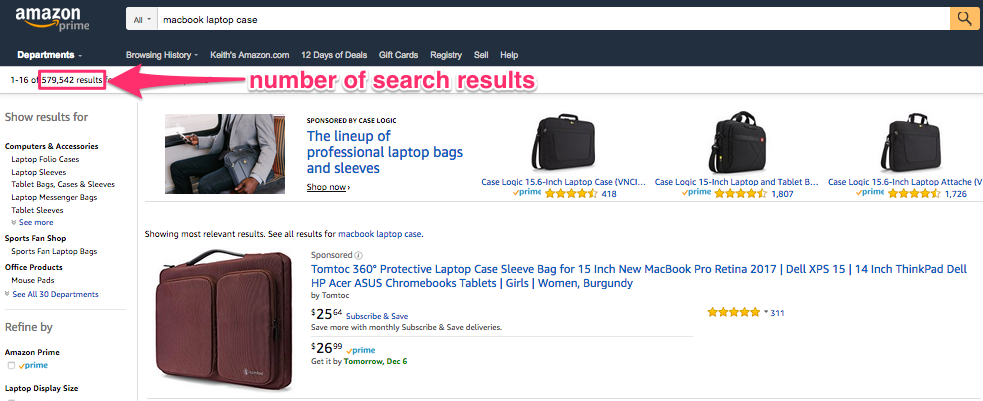

How many merchants are offering your product

A large number of sellers offering your product is another clear sign of high demand. If multiple merchants are all trying to profit off the same items, there’s usually enough buyer interest to sustain sales.

You can see how many sellers are offering your product by doing quick searches of your main product keywords on Amazon, eBay, and Walmart’s sites. You can easily check the number of search results similar to your product to see how many different merchants are offering similar items.

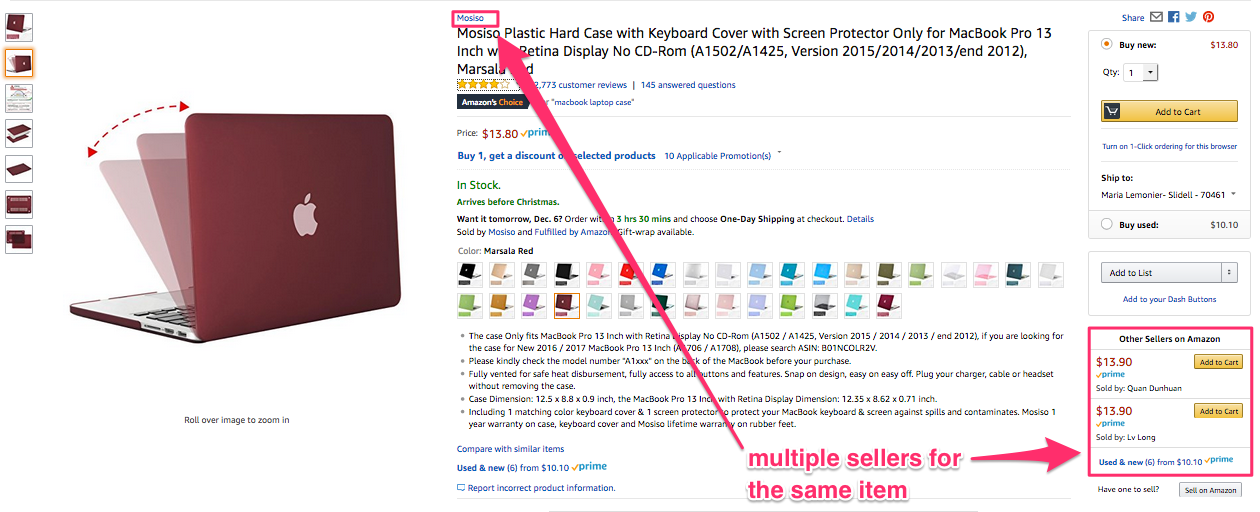

Sellers can share listings on Amazon and Walmart if they’re offering identical products, so be sure to count the number of merchants on individual listings for products that are similar to yours.

This step is particularly important if you’re selling the exact same products as other merchants. Seeing how many sellers are offering the same item as you provides a clear sense of how well you’ll actually perform on that marketplace. If there are a lot of merchants on the listing you’d share, you know that the demand from buyers for your product must be high on this venue.

While demand is essential for profitability, a high number of sellers offering your products also means greater competition. If there are a lot of merchants selling your products, make an effort to highlight the unique aspects of your business with a diverse marketing strategy. Also consider whether you’re offering competitive pricing. Customers will likely be dissuaded from buying if your rates are much higher than competitors’ prices, regardless of your product’s demand.

How often your product is being sold

Don’t stop at checking the number of merchants selling your items — you’ll also want to make sure these merchants are actually selling your products to assess demand further. Merchants, for example, might flock to sell hyped-up, fad products, but sales quickly slump once the buzz dies down. Make sure your product has consistent demand, and isn’t just a trend, by checking its number of sales.

Checking whether your items are selling varies from site to site, so we’ve broken down the best methods for each of the main marketplaces:

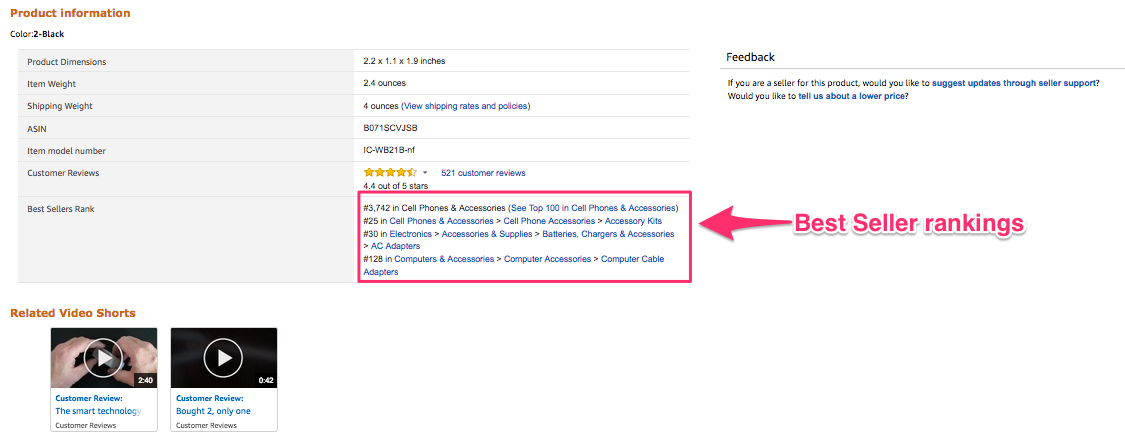

- Amazon: Check the Best Sellers Rank of items identical or similar to your products. You can view these rankings on a product’s listing page by scrolling to the Product Information subsection.

These rankings indicate how the product’s order quantity compares to other items in its main category or subcategories. Low rankings for items that are similar to yours, particularly in smaller subcategories, is often a sign that your product has low demand. It’s best to double-check the Best Seller rankings of other similar product listings in case low rankings are due to individual listing issues, not overall low product demand.

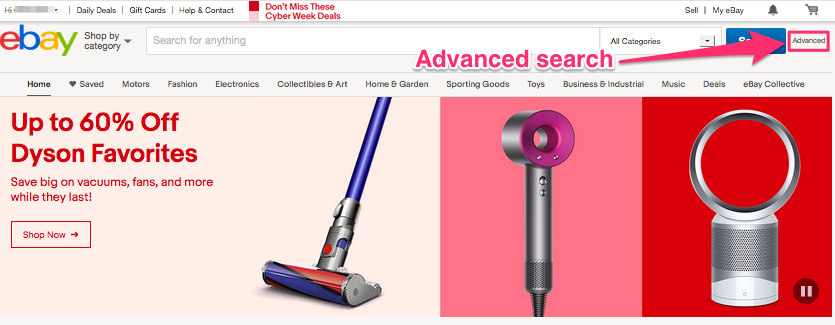

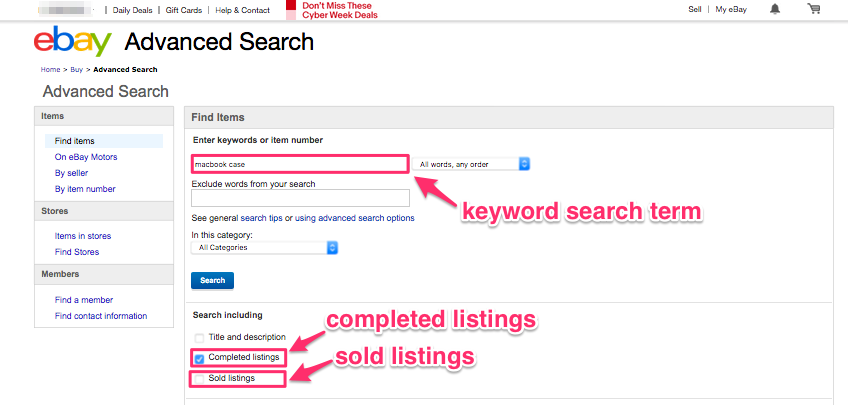

- eBay: The advanced search feature on eBay enables you to check how many items have actually sold versus the total amount of listings. To use this feature, click Advanced on the left-hand side of eBay’s home page.

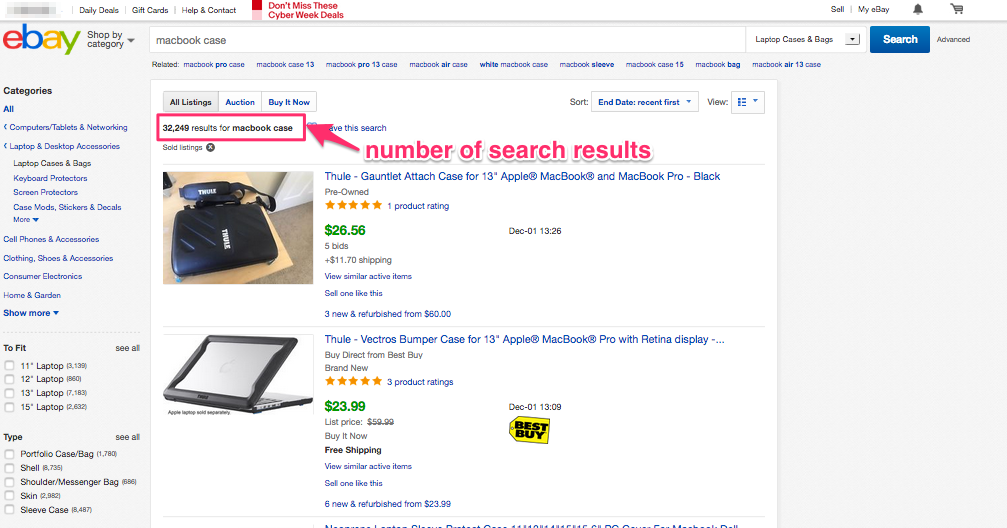

Type in your product keyword, and do separate searches for completed listings and sold listings.

Compare the amount of search results for sold listings and completed to determine whether there’s high demand for your products.

If the ratio of sold to completed is high, a good percentage of merchants are selling your items and demand is strong.

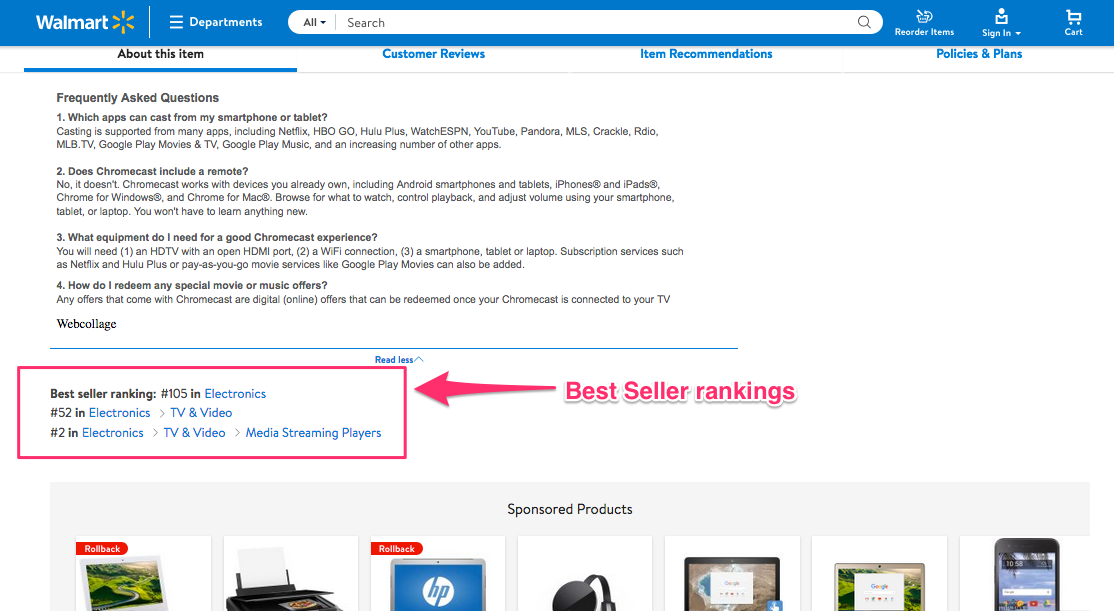

- Walmart: Like Amazon, Walmart site visitors can check how well products are selling with best seller rankings on product listing pages. Scroll down to the bottom of a listing’s product information to view the rankings.

If you see that a product has a high ranking in a subcategory, click on the subcategory to check its size. Walmart has quite a few subcategories, so a product may have a high ranking in a subsection because there’s less competition, not because it has high demand. It’s also best to check other similar listings’ rankings to gain an overall picture of the product’s demand.

A final suggestion for checking whether products are actually selling across all marketplaces is looking at product reviews. A lot of feedback is a clear sign that a product has many buyers.

With positive feedback, a large amount of reviews also represents high buyer engagement, another sign of healthy demand. Your items aren’t just being purchased frequently — customers are actually emotionally invested in what you’re offering and care enough to share how much they enjoy your products.

Finding healthy margins

Cost is the second key component of profitability. You have to keep an eye on costs to make sure they don’t surpass your revenue and wipe out your profits.

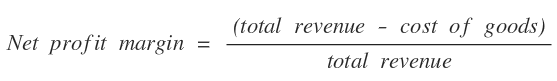

That’s where margins come in. Your net profit margin is the difference between your revenue and the cost of goods, divided by your total revenue.

There’s no exact benchmark for this figure since profitable margins vary by industry and selling volumes (a low margin product can still rear profits if enough are sold). Generally though, healthy margins are close to your industry’s average and gradually increase over time.

The key to maintaining this healthy net profit margin is monitoring costs. You have to know when expenses increase so you can maintain and improve your margins by increasing revenue or lowering costs. Three major expense areas for ecommerce sellers are:

- sourcing methods

- marketplace fees

- inventory management

We’ll explain the best ways to spend effectively and keep costs low in each of these areas so you can keep your net profit margins high and increasing over time.

Sourcing method expenses

Product sourcing methods, or how you collect your product supply, vary widely in cost. You have to be aware of how expensive each option is to know if you can still a maintain healthy net profit margin with each sourcing type.

Here are three main ways to source a product, each with their respective margin brackets:

- Manufacturing: With this sourcing method, you find an outside producer to create your unique product that no one else is selling. Manufacturing requires high upfront costs since most manufacturers have a high minimum order amount. However, manufacturing keeps your net profit margin high if you manage to sell your ordered products since this sourcing method offers the lowest cost per unit. Generally, manufacturing has the greatest margin potential over other sourcing methods.

- Bulk buying/wholesale: Buying in bulk from a wholesaler involves purchasing a large amount of already-produced items to sell for a higher price. With this sourcing method, you have the benefit of selling inventory that’s trusted with validated brand names. However, using known products also means that competition is stiffer and you’ll have to work harder to differentiate your business. The brands you buy from also sometimes have price controls to prevent you from selling at lower, discounted rates. With these restrictions, the margin potential of bulk buying is generally higher than dropshipping, but not as high as manufacturing.

- Dropshipping: Dropshipping is selling products you don’t own or store and forwarding those sell orders to a dropshipping partner or supplier to fulfill the order. With this method, you earn a profit on the price difference between what you charge buyers and what your dropshipping partner charges you. The biggest advantage of dropshipping is the low startup cost—you don’t have to purchase or manage the inventory. However, this method has the lowest margin potential since you have to deal with dropshipping partner charges and even higher competition with other sellers than with bulk buying.

Being mindful of different sourcing methods’ costs keeps you in control of your profits. Picking the right sourcing method involves considering your product’s unique qualities to determine whether it’s more suited to one method. You’ll also have to consider factors that impact your revenue — your selling volume, product prices — to decide which methods fit your budget.

Factoring in marketplace fees

Your net profit margin can also be lessened by marketplace fees. Each venue has a unique fee structure that you have to understand in order to control costs and grow your profits. We’ll cover how selling fees are calculated on Amazon, eBay, and Walmart so you can account for them in your budgeting:

- Amazon: Your regular fees as an Amazon merchant depend on what type of selling account you have — Individual or Professional.

- Individual sellers don’t pay a monthly fee, but they do pay a $0.99 fee per item sold.

- Professional sellers pay a $39.99 monthly fee, but they don’t pay a regular per item fee.

Besides these regular payments, Amazon also charges sellers order-based fees.

-

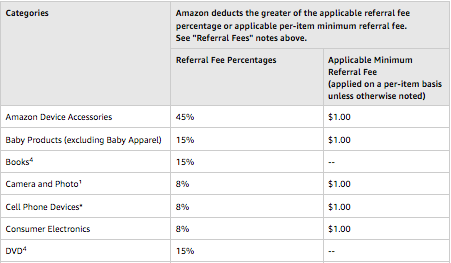

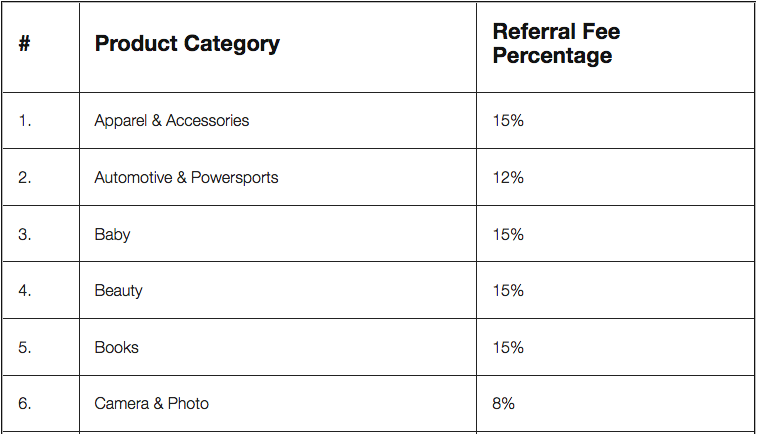

- Referral fees: Amazon sellers pay referral fees that vary by product category for every sold item. The referral fee is a percentage of the item price excluding taxes. There is a minimum amount that must be paid in referral fees in each product category. Here are a few referral category fee rate examples for different Amazon products.

-

- Closing fee: Sellers pay Amazon a closing fee of $1.80 per sold media item.

- High volume listing fee: Amazon charges a high volume listing fee of $0.005 per ASIN on non-media items if the ASIN is over 12 months old and it hasn’t been sold by any seller in the past 12 months.

- Refund administration fee: If you refund a customer for an order, Amazon refunds you your referral fee minus a 20% refund administration fee.

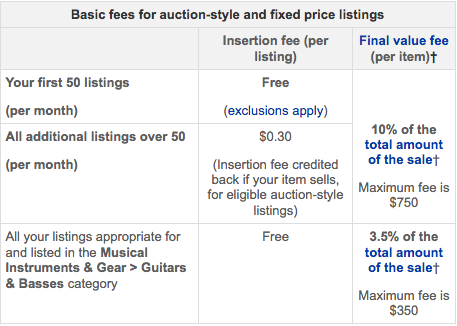

- eBay: eBay’s basic selling fee structure is simpler than Amazon’s. It’s not tied to different seller types, minimally tied to product categories, and only involves two main fee types: insertion and final value fees.

- Insertion fees: eBay charges a $0.30 insertion fee per listing after a seller’s first 50 listings per month. These first 50 listings are not charged for an insertion fee.

- Final value fees: eBay charges sellers a 10% final value fee per sold item on the item’s total sale amount (including item price, shipping, and any other charges, excluding taxes). Products listed in the Musical Instruments & Gear > Guitars & Basses category are charged a slightly smaller final value fee at 3.5%.

Here’s a breakdown of eBay’s basic fee structure:

The marketplace does have advanced listing upgrade and supplemental listing fees, but these charges are circumstantial and don’t apply to every seller.

- Walmart: This marketplace only charges a referral fee on each sale, without any setup, subscription, or monthly fees. The referral fee percentages range from 6-20%, depending on the product category.

You can view the full list of Walmart referral fee rates by product category here.

Marketplace fees can’t be ignored if you want to keep your ecommerce business profitable. These fees vary widely by venue and product category (so they need to be tracked), and they can have a significant impact on your net profit margin. Identify which product categories your inventory falls into, and check your items’ fee rates to ensure that you can maintain a healthy profit margin on your chosen marketplaces.

Costly inventory issues

Efficient inventory management is critical when it comes to your net profit margin. Why? Inventory management errors are costly.

Poorly managing your inventory can lead to you accidentally overselling, for example. With active listings out of stock, you miss opportunities to earn revenue and lose unhappy customers who wanted to place an order. Inefficient inventory management can also lead to overstocking your items. You pay a high amount to order a large amount of products, but the buyers’ demand for your items is too low and you can’t make a profit on your large order.

These inventory mistakes can cut down your net profit margin and hurt your ecommerce business if the issues aren’t addressed. Avoid costly management errors by streamlining your inventory process. Identify where mistakes are happening, and actively make changes, such as adding extra protocols or hiring more inventory employees, to avoid future mistakes.

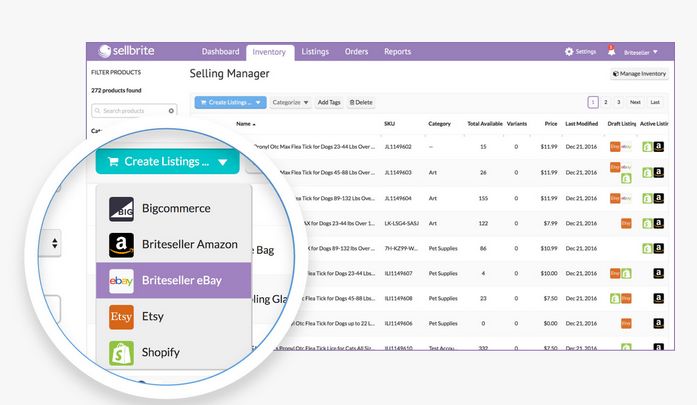

One of the most cost-efficient ways to improve your inventory management is to use a software program, like Sellbrite. It doesn’t matter how many channels you sell on — with our tools, you can monitor and adjust your entire inventory from one central hub. You avoid costly overselling and overstocking with automatic inventory updates every time an order is placed.

Want to learn more? Speak with a product specialist at Sellbrite to see how we can improve your inventory management to help you achieve healthy profit margins.

Balance demand and margins for profitability

Running a profitable ecommerce business isn’t a matter of luck — it’s a calculated effort that requires constant observation and iteration. You need to track the demand of your products to estimate how much you can sell and earn on your orders. You also have to regularly calculate your net profit margin to assess what steps you need to take, such as cutting costs or increasing sales, to maintain profitability.

The demand for your products and your net profit margin both don’t need to be perfect. A seller with high-demand, low-margin products could easily earn as much as a merchant with low-demand, high-margin items. The key is to track both factors to identify which areas need adjustments to achieve the greatest profits.

3 thoughts on “Formula For A Profitable Ecommerce Business”

Pingback: Should You Sell on Amazon And eBay? |

Pingback: Should You Sell on Amazon And eBay? |

Pingback: Should You Sell on Amazon And eBay? |